Dear Financial Future: Designs for the Younger Generation's Better Financial Decisions

Shin Young Park's thesis, Dear Financial Future: Designs for the Younger Generation's Better Financial Decisions, innovates tools to help the younger generation make rational financial decisions to better prepare for their futures. Throughout this project, Shin Young spoke with experts across the fields of economics, cognitive psychology, banking, and education to envision a range of design interventions, from tools to help with smarter spending to a platform that assists young people to better plan for their retirement.

“Not everyone has the privilege of having a financially healthy family and friends around them. This led me to design tools that allow individuals to connect with and learn from people outside their inner circle.”

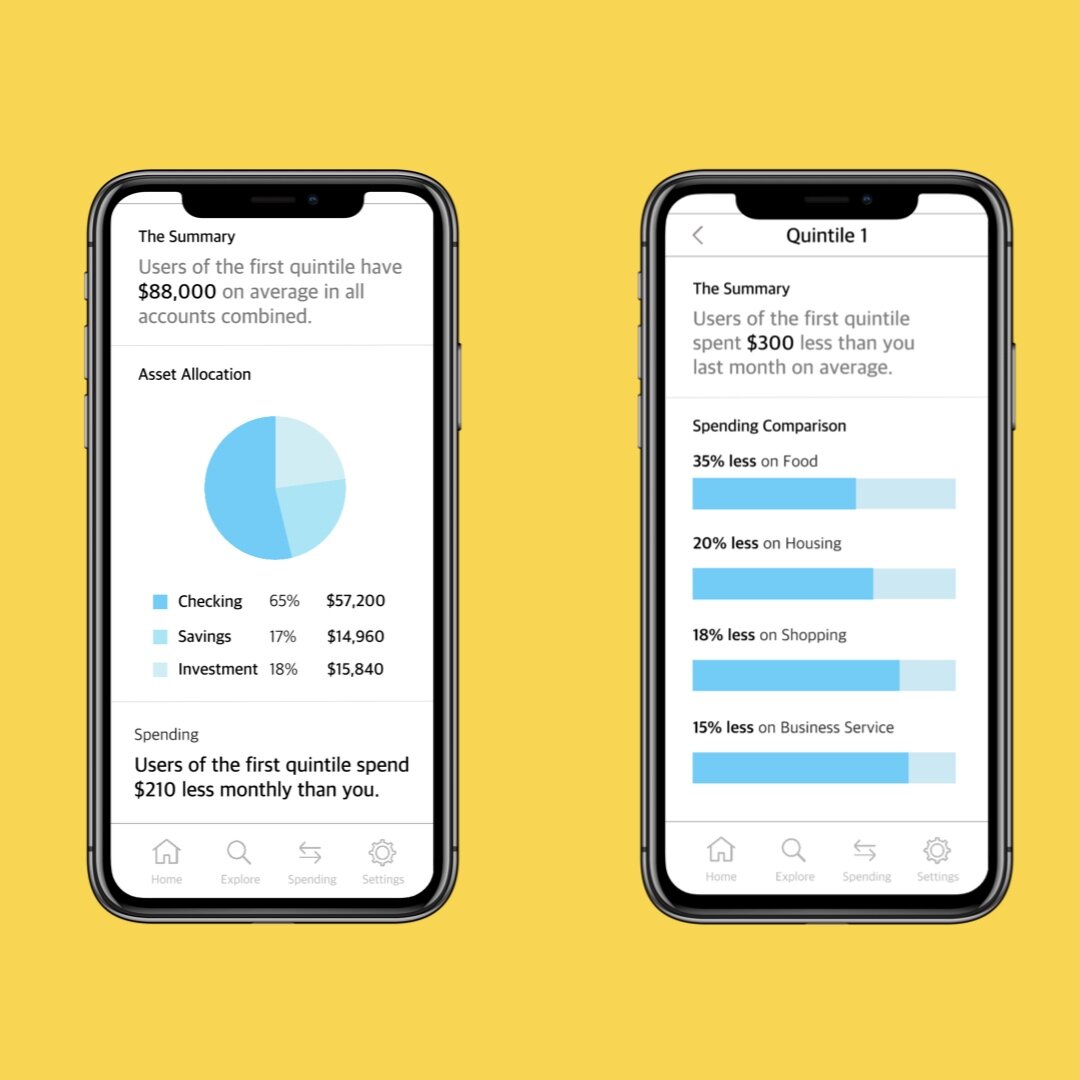

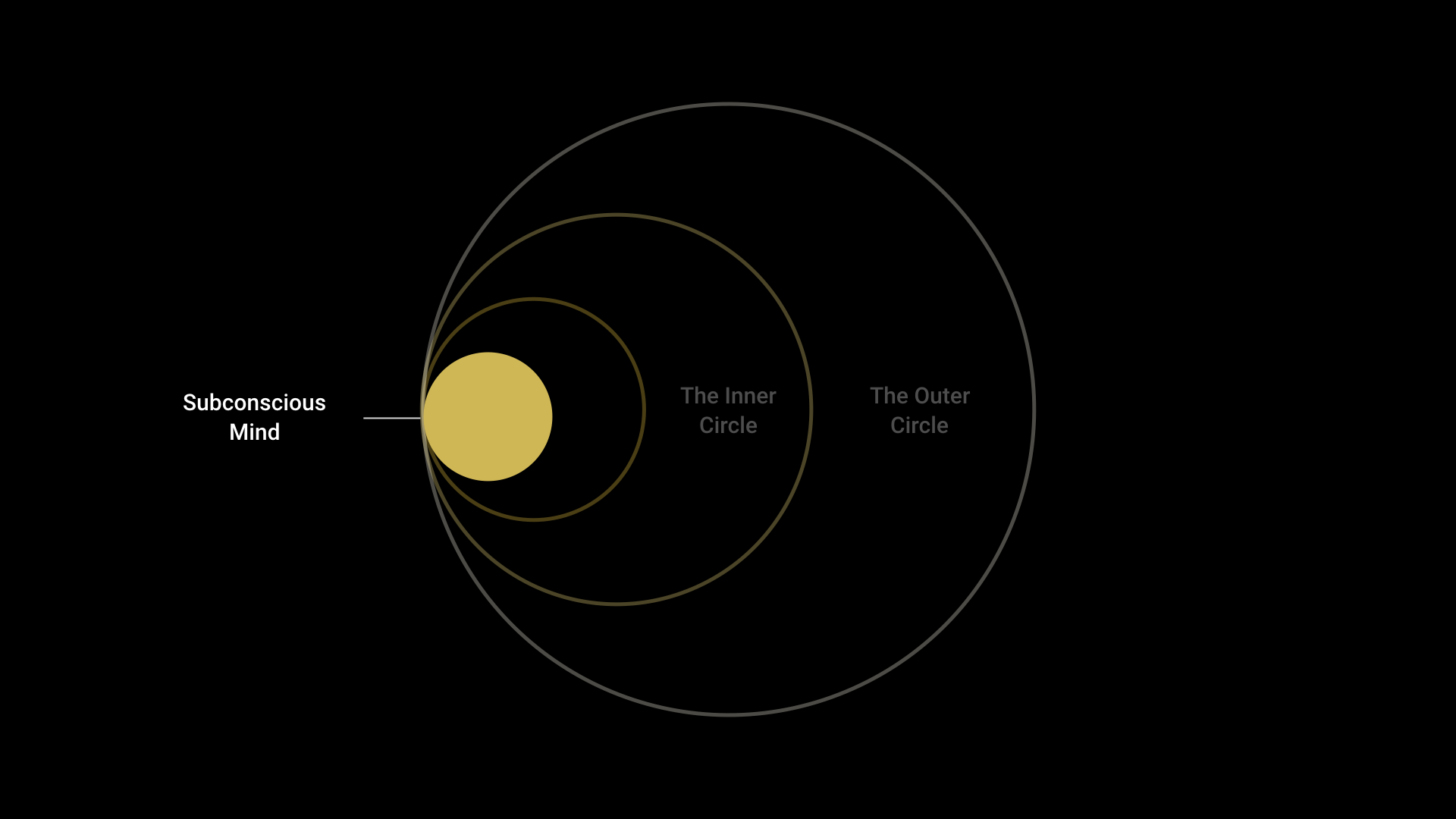

She started her investigation by designing self-help tools. However, as she proceeded with her research, it became clear that financial habits and decision-making are primarily influenced by how the people closest to them manage their money. “Not everyone has the privilege of having a financially healthy family and friends around them. This led me to design tools that allow individuals to connect with and learn from people outside their inner circle," she explains.

Shophee

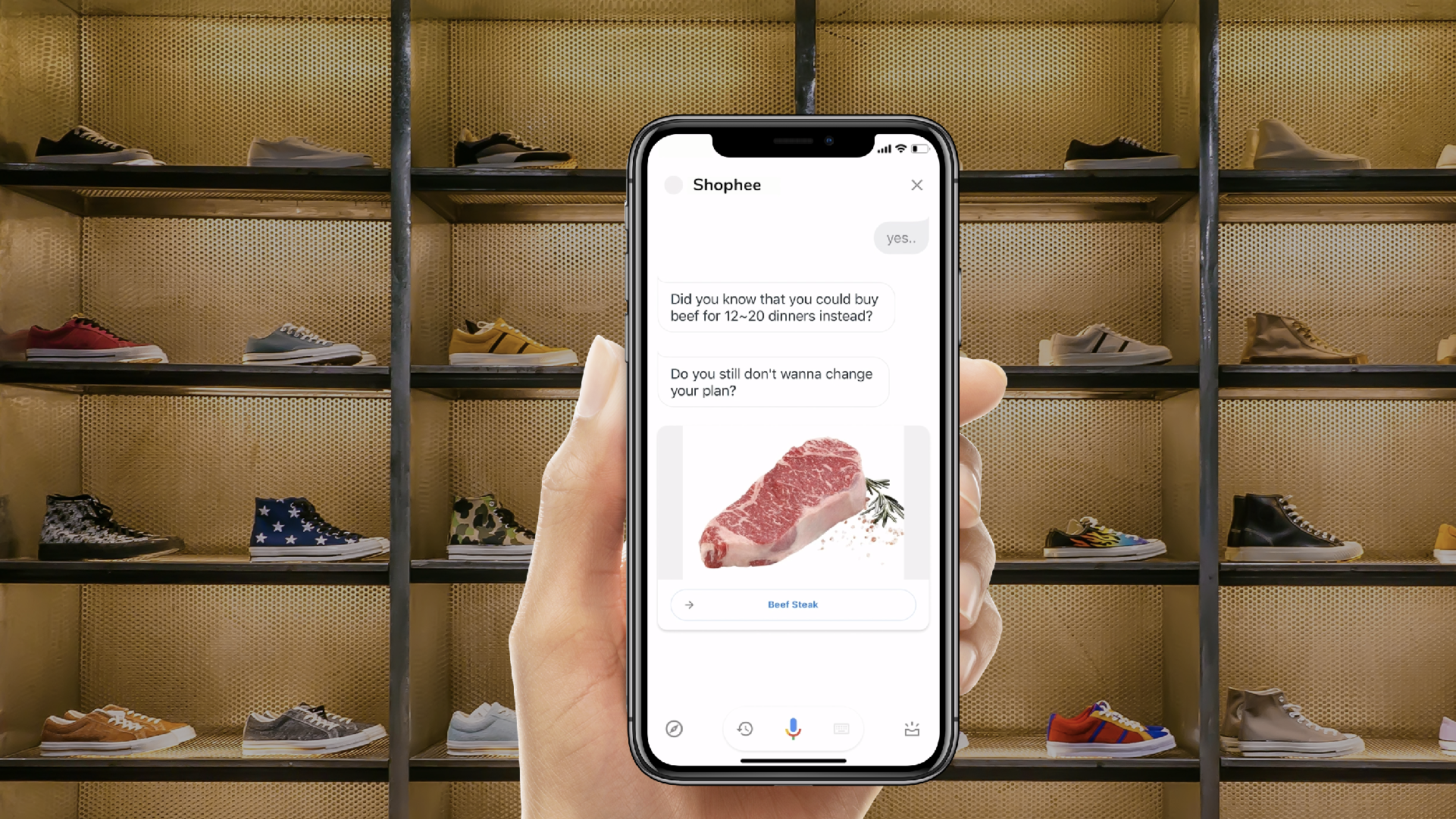

When we make purchasing decisions, we often have blinders on. We are so focused on the instant gratification we'll get from a particular purchase, that we forget about the pleasure or benefits other purchases might bring. Shin Young designed Shophee to help individuals rethink their spending decisions in rational ways by making it easier to compare different options.

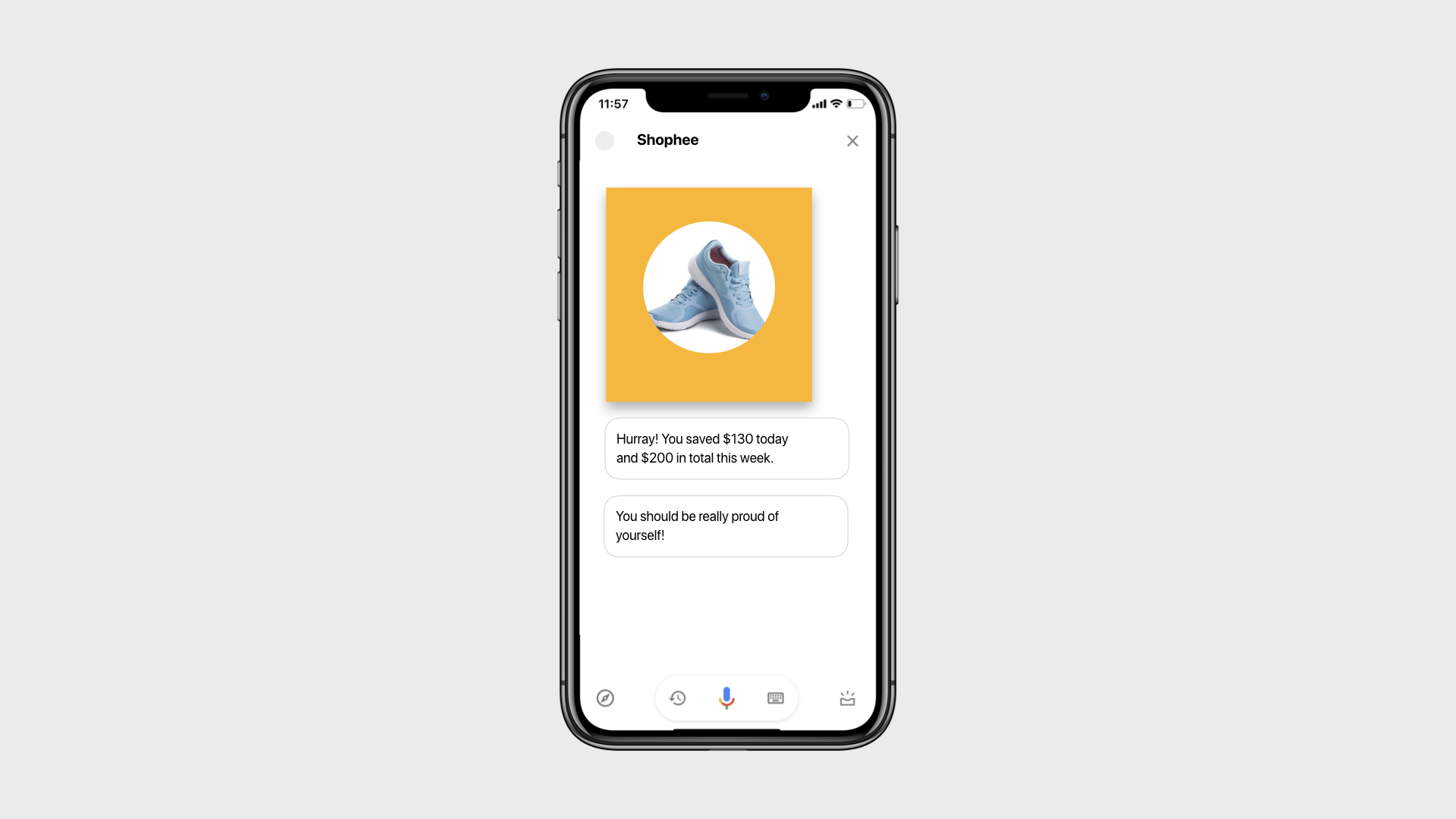

Shophee is a chatbot that asks questions for individuals to think once more before they make purchasing decisions. Whenever you're unsure about whether or not to buy something, Shophee will show you alternative products you might buy instead. For instance, if you're looking at a pair of sneakers, it suggests you could buy 10 servings of steak or save two children from ten diseases by donation. Then, when Shophee successfully persuades you not to buy, the app sends you a collectible and shareable image summarizing what you avoided purchasing and how much you saved by doing so. It also reminds you of the amount you saved that week, which helps you feel proud of yourself and in control.

Dan

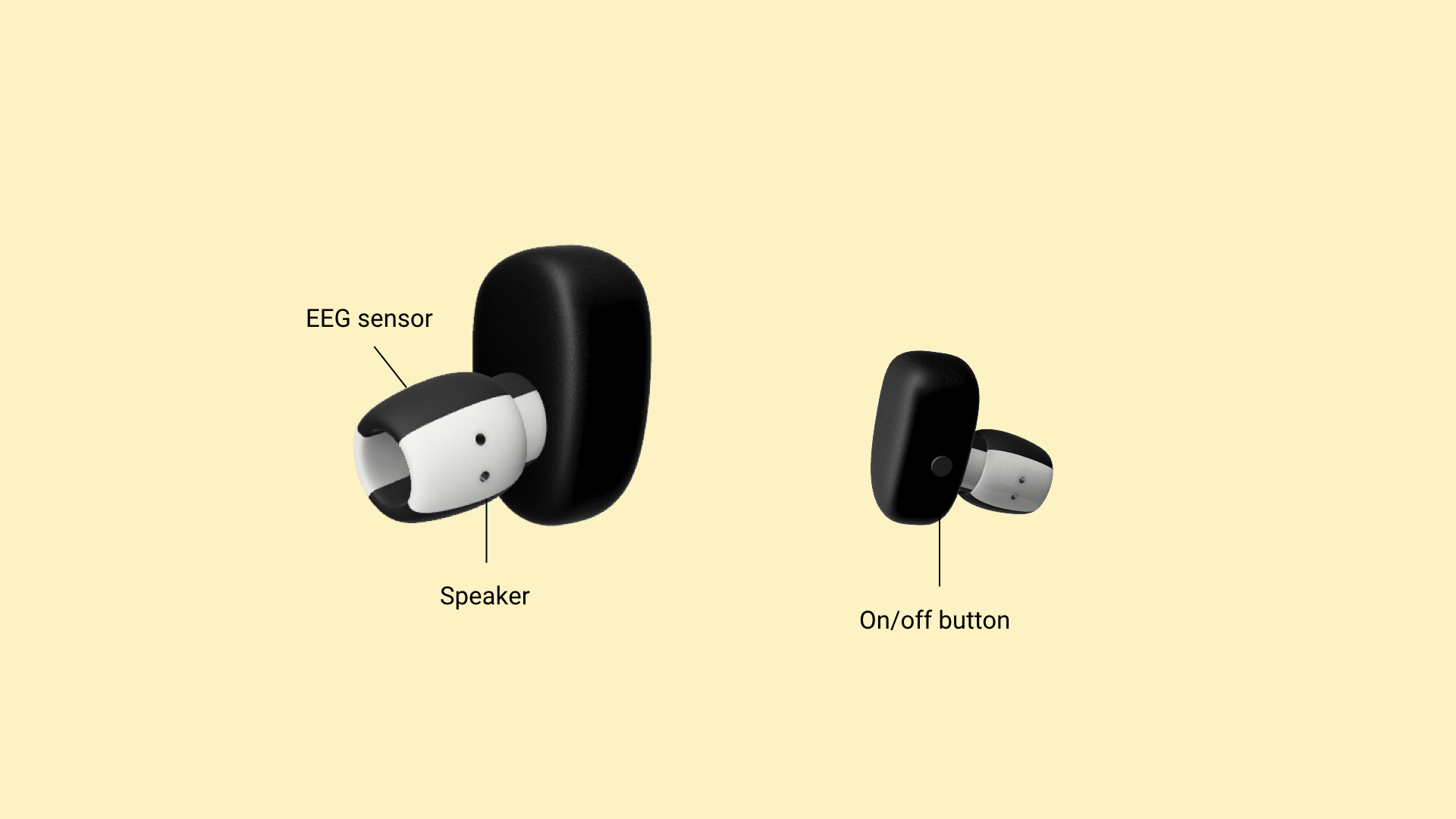

Dan is a wearable mechanism that helps "impulse buyers" control their urges. By detecting users' impulsivity, Dan makes you aware of your subconscious consumption desires through an electroencephalogram (EEG) sensor. This sensor tracks your brain wave patterns to detect impulsivity, while a speaker plays calming, rhythmic music to help listeners reduce impulsivity by activating the brain's neocortex.

Dan's simple shape and black and white color scheme is intentionally designed for discretion so that it's almost undetectable. Shin Young explains that this way, "users of Dan can pretend they are wearing a Bluetooth earbud, so they don't have to reveal that they are impulse buyers who need Dan."

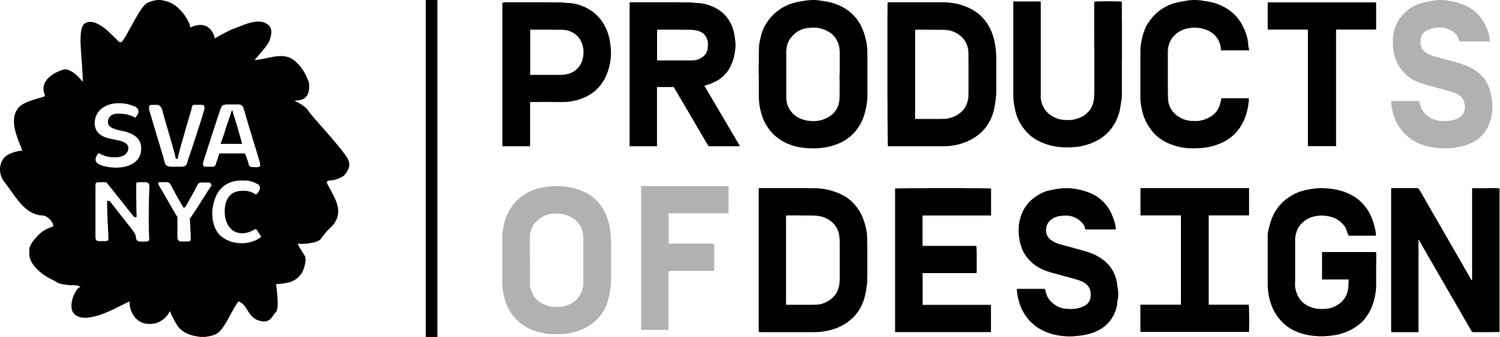

MoneyMirror

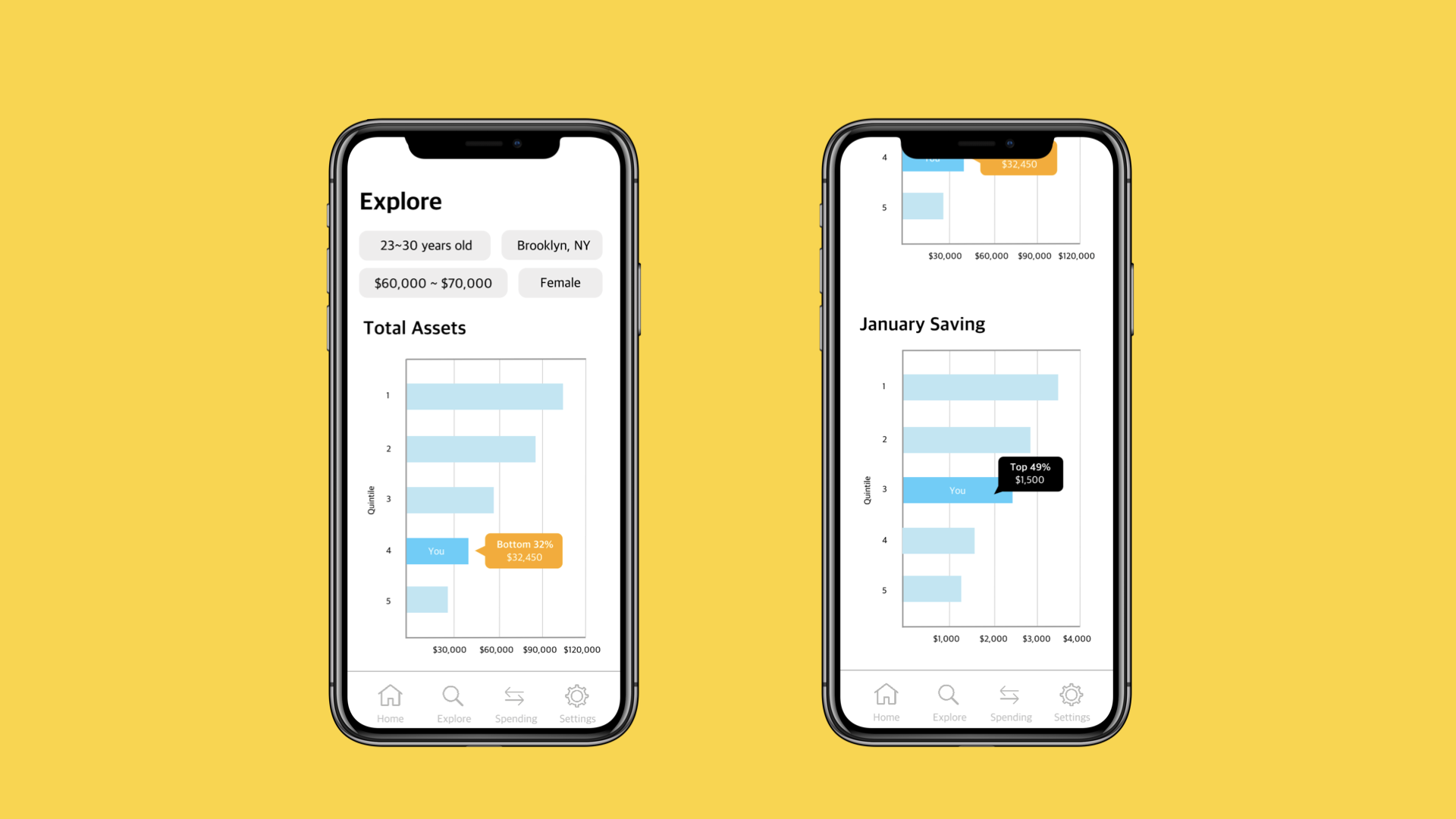

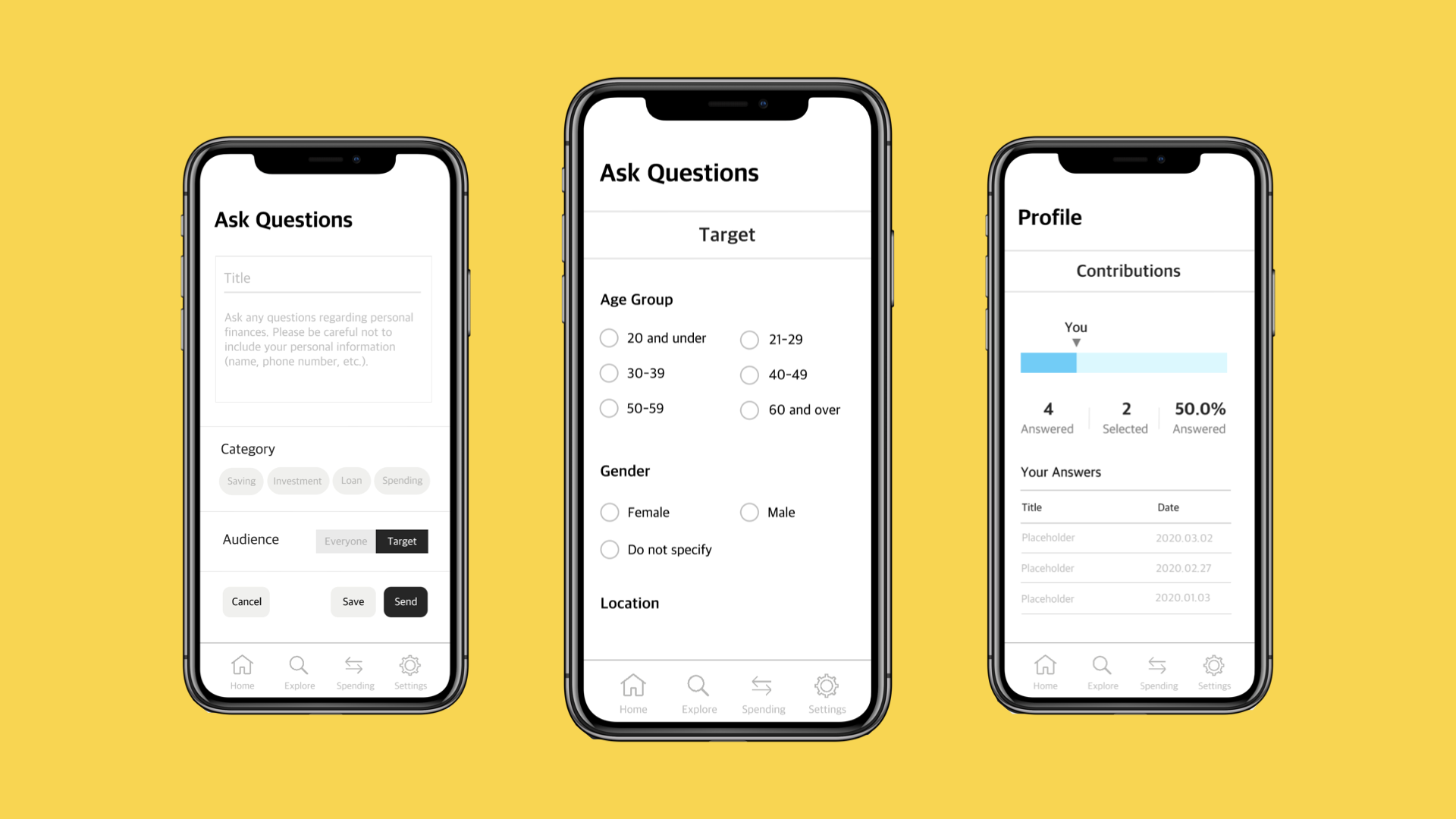

MoneyMirror is an app that allows you to see how people with socio-economic status handle their finances. By seeing real-time data on how local users in similar economic positions save and invest money, you can set a benchmark and learn from others. Shin Young designed the app in response to the generic feeling of most mainstream financial statistics and words of advice. The dialogue around financial management often takes a one-size-fits-all approach, even though the amount of money people spend and save varies hugely based on where they live, how much they earn, and how old they are.

"MoneyMirror is not only a platform but also a community space where you can ask personal finance-related questions," Shin Young shares. In their questions, users can specify a target group to query, allowing for higher quality responses than they might get from asking other online communities. For privacy and security reasons, the app also displays data in aggregated and anonymous forms. MoneyMirror runs off a sliding-scale subscription fee, rewarding those users who answer community questions with smaller subscription fees.

Wisdom

Wisdom is a service that educates young people on how to plan for their ideal retirement life directly from retirees. "For the younger generation, retirement seems too far away, and therefore it is difficult for them to stay motivated to prepare for retirement. Moreover, it is not easy for them to figure out how much they will need to live their ideal lifestyle and start unless they have parents who were well prepared for retirement," Shin Young points out. People in their twenties and thirties can use Wisdom to find and connect with retirees whose experiences they can learn from. Through regular video calls, users receive suggestions from their retiree mentors on savings, financial planning, and even non-financial retirement advice.

The service also doubles as a gig platform for retirees, since mentees pay a fee after each session, a portion of which goes back to the mentors.

The service also doubles as a gig platform for retirees, since mentees pay a fee after each session, a portion of which goes back to the mentors. In this way, Wisdom provides an opportunity for retirees to contribute to society, alleviate loneliness, and feel a sense of purpose.

To learn more about Shin Young Park’s work, take a look at her projects in more detail at shinparkdesign.com.