RICH BITCH: Feminine Strategies for Financial Power

Yuko Kanai’s thesis, Rich Bitch: Feminine Strategies for Financial Power, rejects the expectation that managing money is a masculine endeavor. Through addressing the emotional facets of money, breaking down the taboos of financial discussions, and presenting alternative models of financial success, her thesis aims to elevate femininity as a source of power rather than a handicap. The proposed strategies work at the level of community, the household, and the individual psyche as leverage points to address why financial illiteracy is more pronounced among women.

RITCH BITCH aims to elevate femininity as a source of power,

rather than a handicap when building financial power.

The Merriam-Webster dictionary defines empowerment as “the act or action of empowering someone or something: the granting of the power, right, or authority to perform various acts or duties,” connoting that women’s empowerment is a passive action of receiving power from anexternal source. Rather than adhere to the contemporary notions of women’s empowerment, Yuko reframes this power as something built from within and cultivated through a collaborative transformation.

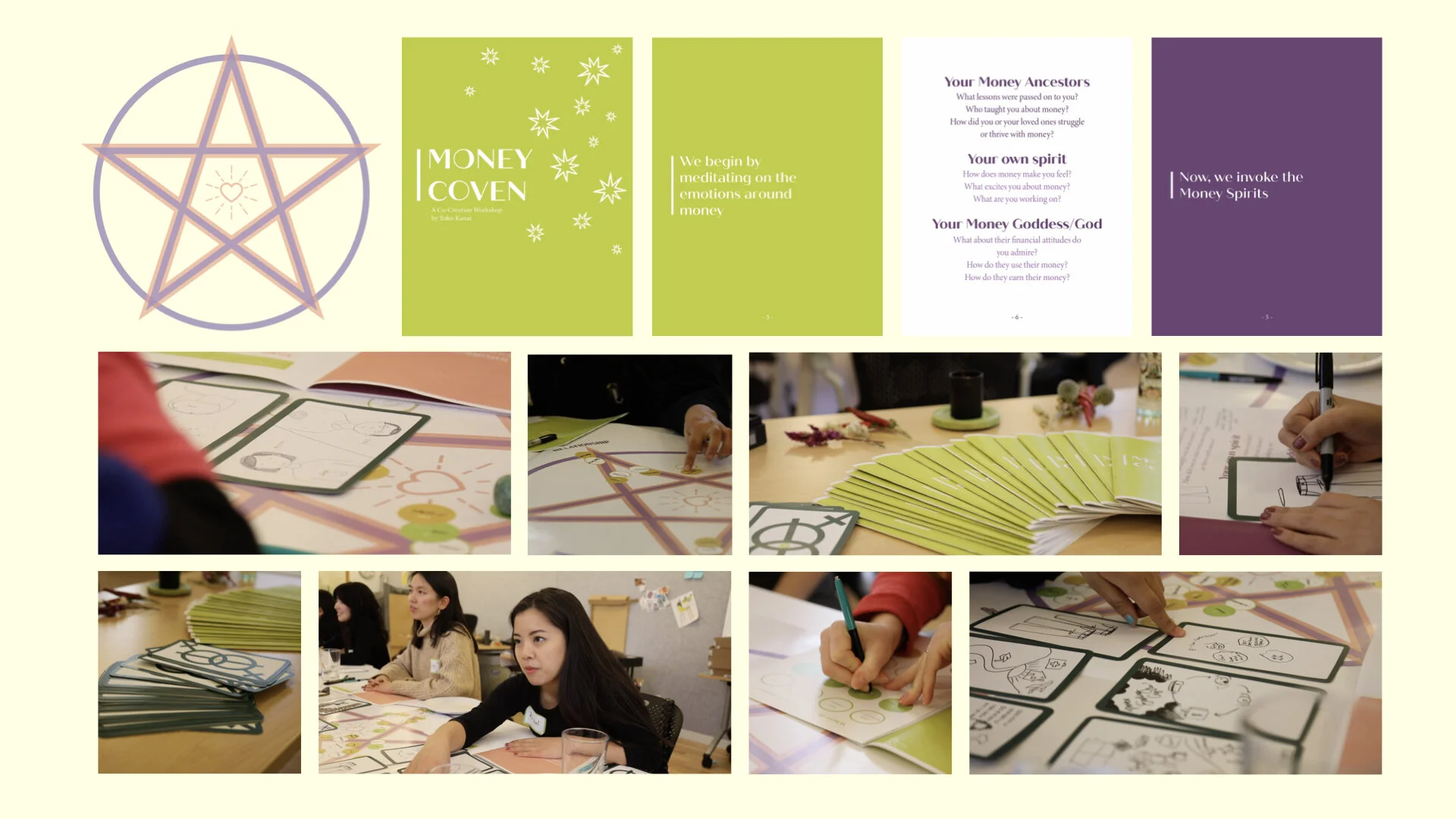

Money Coven Workshop

Many of the financial advisors and experts Yuko consulted emphasized the usefulness of a metaphor to describe otherwise opaque financial concepts to clients. In the search for her own metaphor, she began with the question, “What kind of women exercise their unique power and

reject patriarchal expectations?” and was drawn to the witch. Throughout history, witches have been persecuted for violating gender expectations and performing magic that was sanctioned only for men. The witch would become the model for the original Rich Bitch.

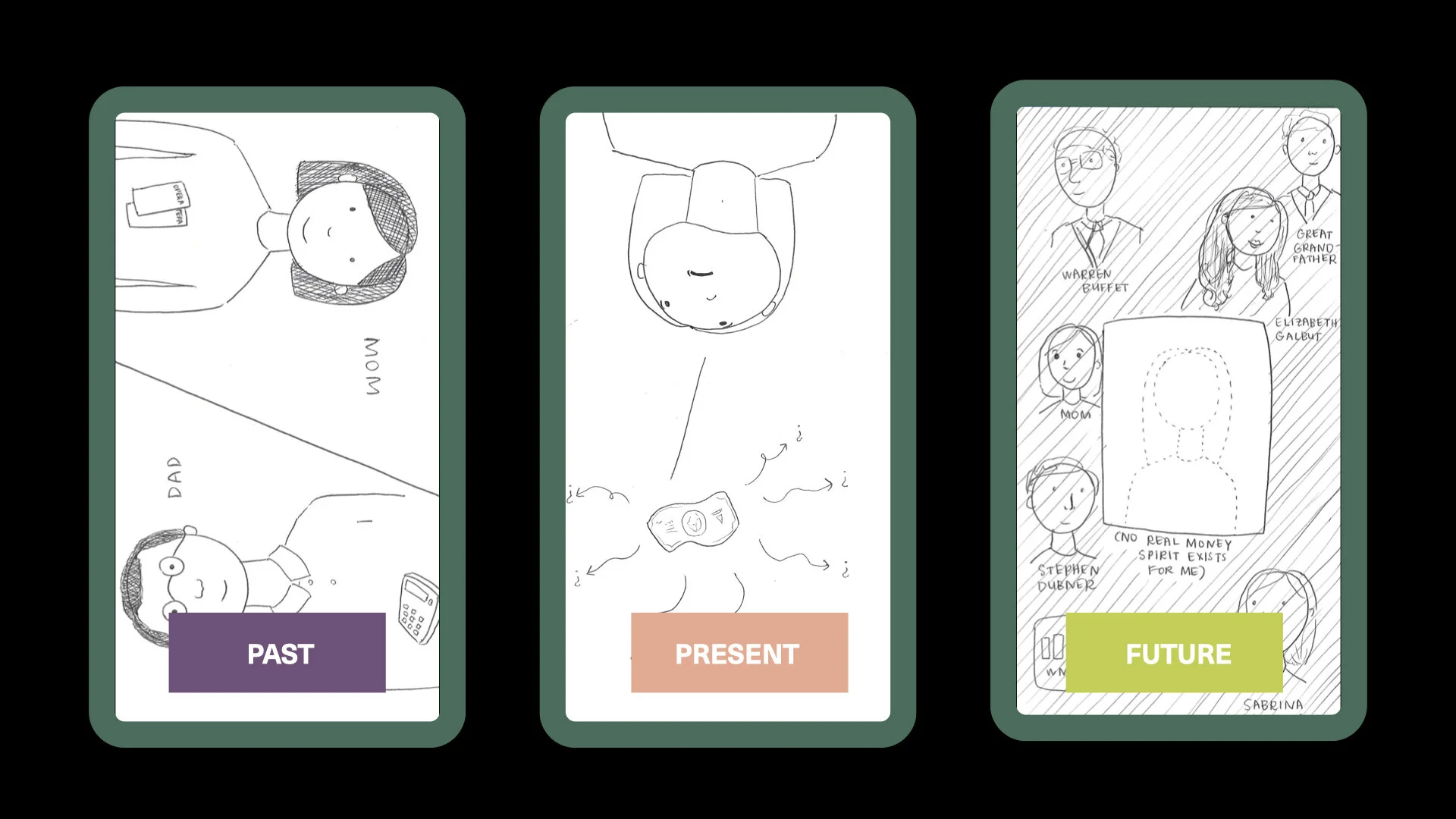

Yuko invited seven women to the SVA GroundFloor Incubator for a co-creation prototype of the Money Coven service. They began the session with a mapping exercise on a pentacle to pinpoint their emotions brought about by the topic of finances within various areas of their lives. They then invoked the “Money Ancestors,” their own spirit, and “Money Goddesses,” with a series of prompts around their values and hopes. These were revealed to be their past, present, and future, completing a financial narrative.

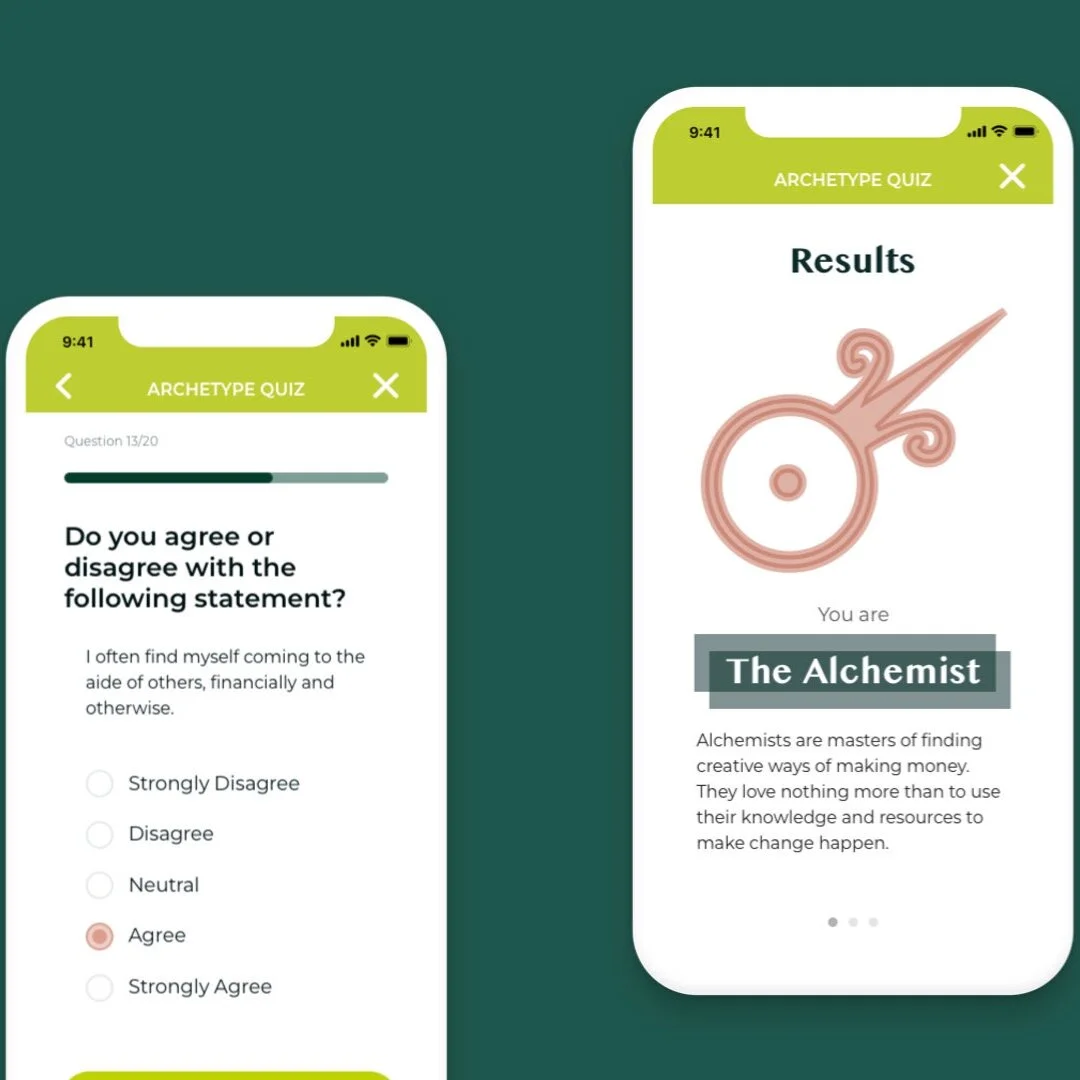

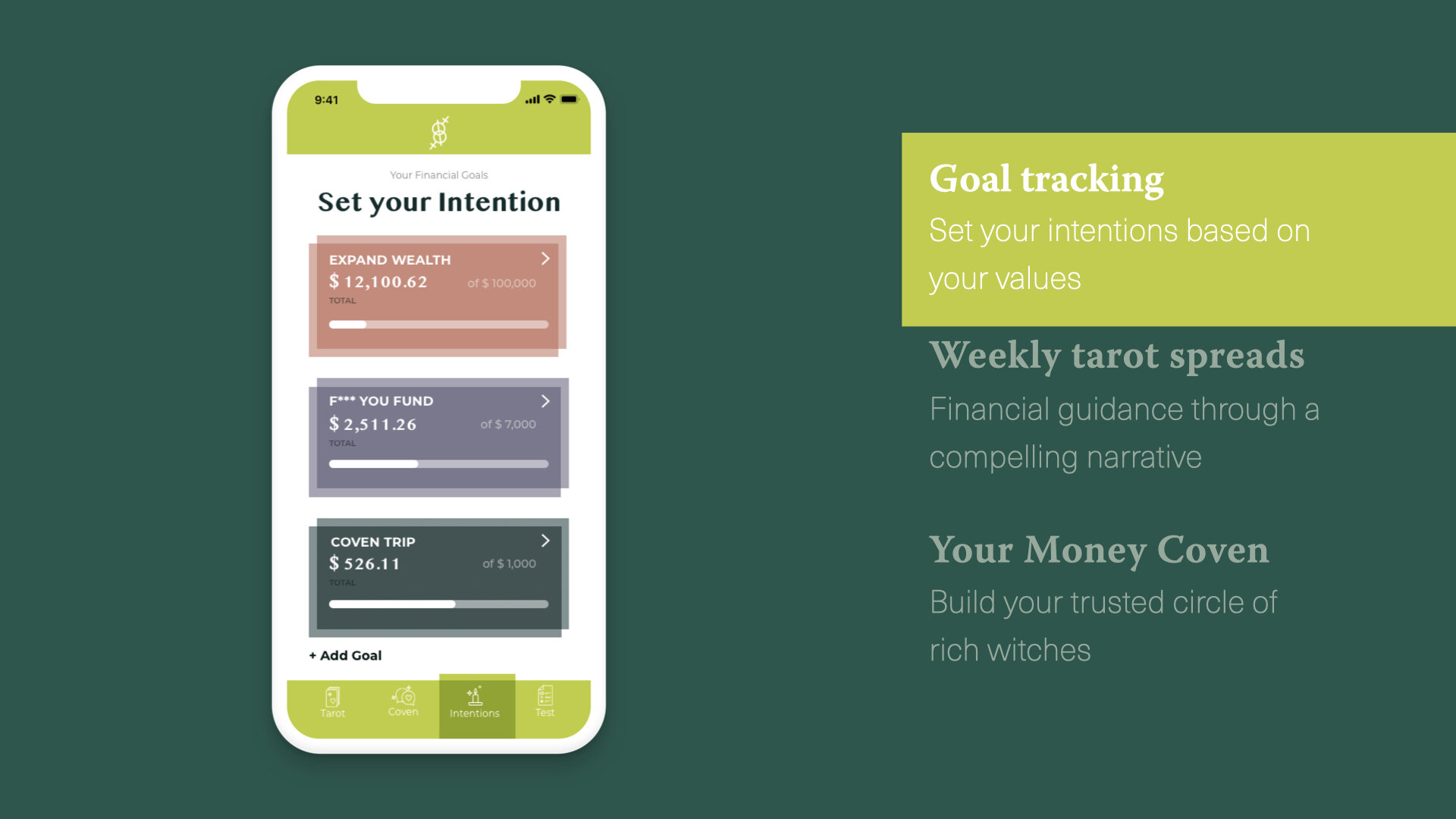

Money Coven App

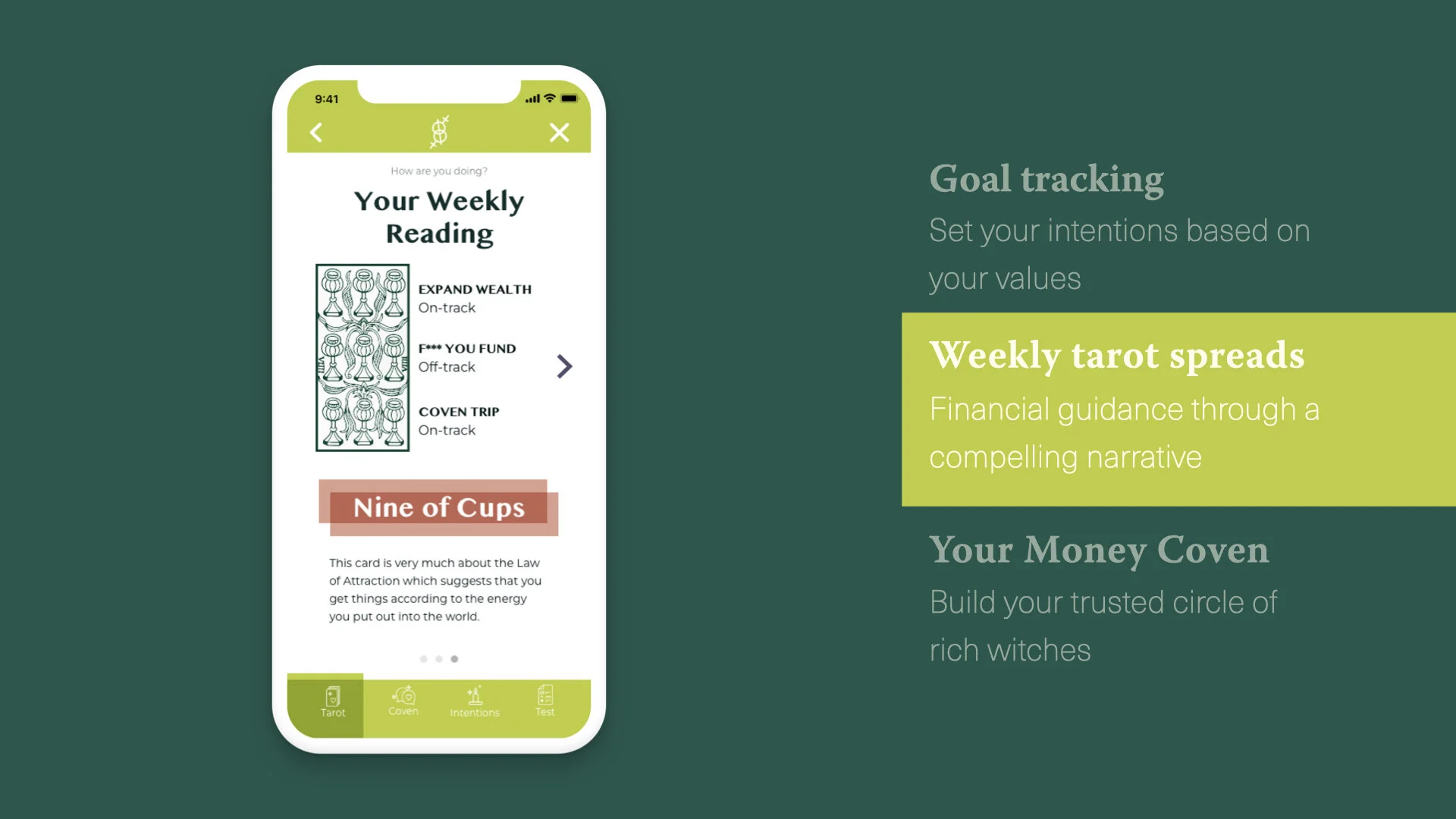

In the Money Coven app, an assessment of the user’s financial attitudes and values uncovers their Money Archetype. In Jungian psychology, archetypes are character or behavior models that we, sometimes subconsciously, use to shape our own personalities. Many of the archetypes in the tarot cards are also present in psychology literature, so Yuko leveraged the complementary practices to produce a compelling and unconventional narrative within a personal finance app. Yuko explains, “Identifying your archetype is useful because, when you can observe an archetype operating within you, you then have the opportunity to differentiate yourself from it.”

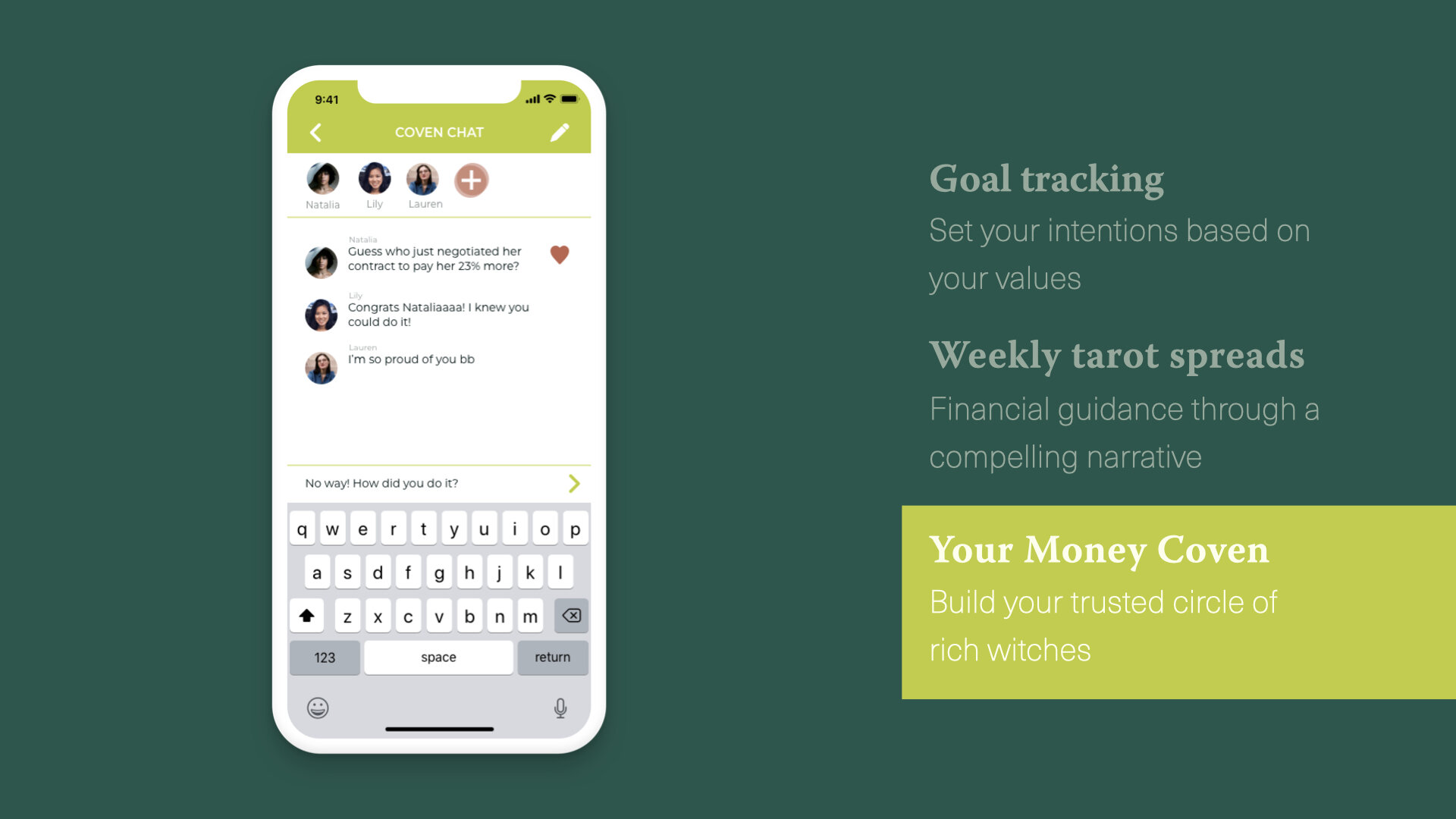

Money Coven leverages feminine strengths in goals-based financial guidance that is tailored to its user’s values. After setting goals in the form of intentions, the app tracks the user’s behaviors, and Money Coven delivers a weekly tarot reading to let them know how they have been doing. It reveals financial patterns and divinations with language that emphasizes the capacity within to manifest abundance to users who can reflect on their progress and their behaviors. Because financial growth is a collaborative process of open discussion and vulnerability, the app is a platform for creating the user’s own Money Coven. Through building this trusted network of peers to lean on for support and accountability, users are much more likely to fill gaps in knowledge and feel confident moving forward in their financial lives.

The Vault

Financial power is key to correcting gender inequality, but there are social differences between men and women around financial behaviors. Women are becoming more financially independent than ever before, but many still struggle with the confidence to participate in high-risk, high-reward investing opportunities. As a result, women are often dismissed as being “risk-averse,” but “it doesn’t reflect the reality that, perhaps we need a redesign of financial services to communicate risk more effectively, in ways that acknowledge the feminine experience.”

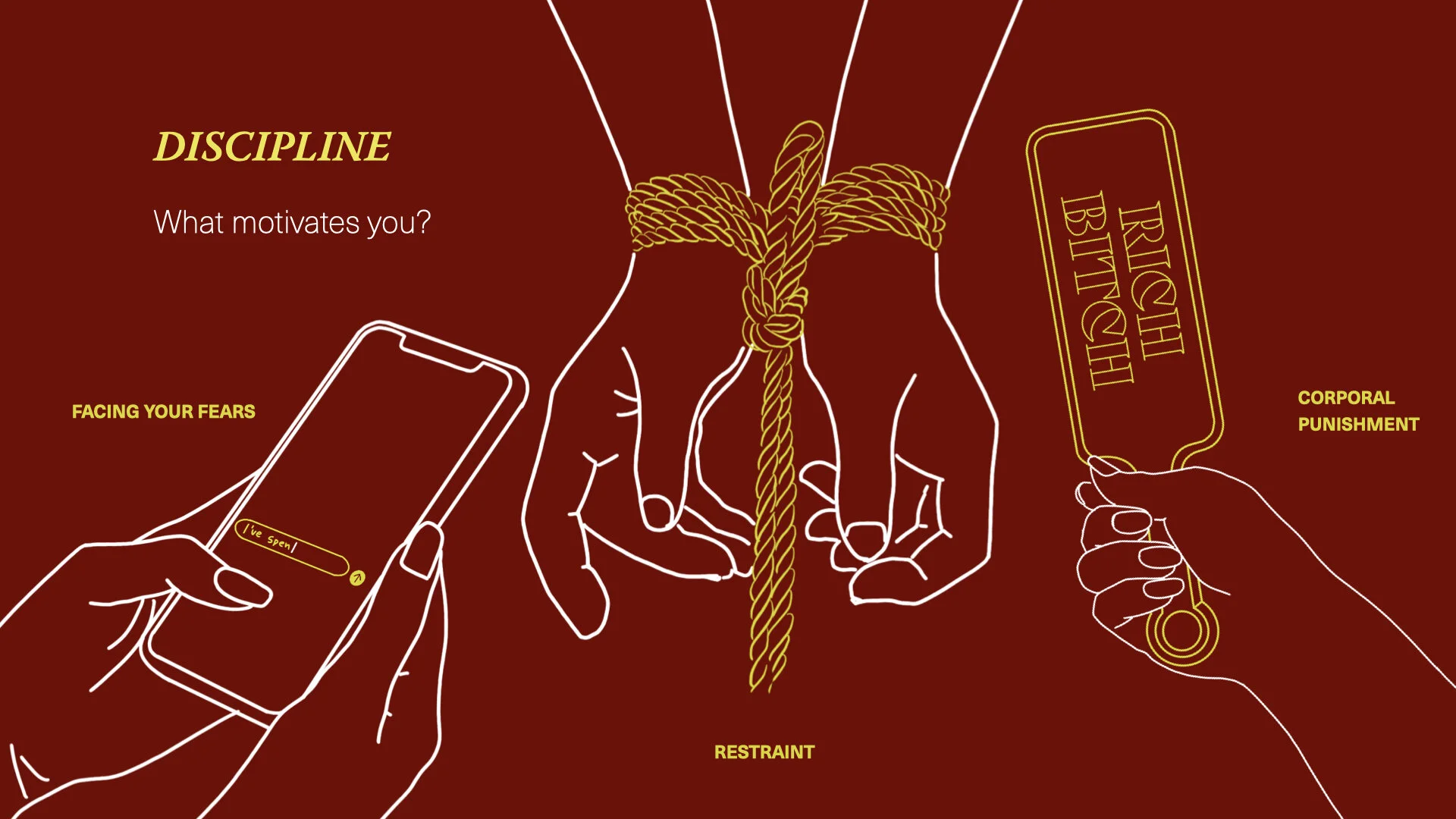

In envisioning the ideal financial coach, Yuko fuses the analogous practices between BDSM and financial coaching because, “when it comes to risk, BDSM practitioners are the experts. The activities are inherently risky and therefore require vigilant risk-management.” At The Vault, professional dominatrixes deliver financial guidance and discipline to woman-identified clients who wish to transform their financial behaviors. The combination of the professional dominatrix’s unapologetic and taboo expression and femininity and the financial knowledge required of coaches make her the consummate financial coach for a very niche clientele. These clients practice managing risk and reward within an extreme but highly controlled environment that is designed to encourage growth and personal accountability over time. Making decisions about the long-term future can feel disconnected from the present and nebulous, but the physically embodied experience at The Vault forces consenting participants to recognize the tangible impact of decisions made today.

The Vault: Tools

As the client lays out her cards and bares all her secrets, the domme places a collar around her neck, reassuring her that she has seen it all. “The contract between a dominant and a submissive requires immense trust. Not just about the client’s physical safety, but emotional as well,” says Yuko. As the collar handle rotates and latches shut, the client is locked into their role as the submissive for the entirety of the session. The session will always conclude with a ritual release, signifying the transfer of power and responsibility back to the client. Between each session, the client carries the personal responsibility to discipline herself based on the plan that was laid out to them by her domme. She will receive this silver keyring, which serves as a connection to her domme and reminder of her potential to become a rich bitch.

The Vault App

The first step in any dungeon and financial services experience is obtaining consent and negotiating boundaries. The process determines just how much risk the client is willing to take in order to reap a particular reward. Before arriving at her session, the client responds to a set of prompts on The Vault app to communicate her needs, desires, and boundaries. Yuko offers, “this will let her domme know what ‘makes her tick.’” Upon establishing her safeword at the end of the onboarding process, the client then enters the physical session with her Money Domme and undergoes an embodied transformation from a place of financial submissiveness to dominance. The process is on-going, so the Money Domme will hold the client accountable by tracking their financial behaviors through the app.

Power Couple

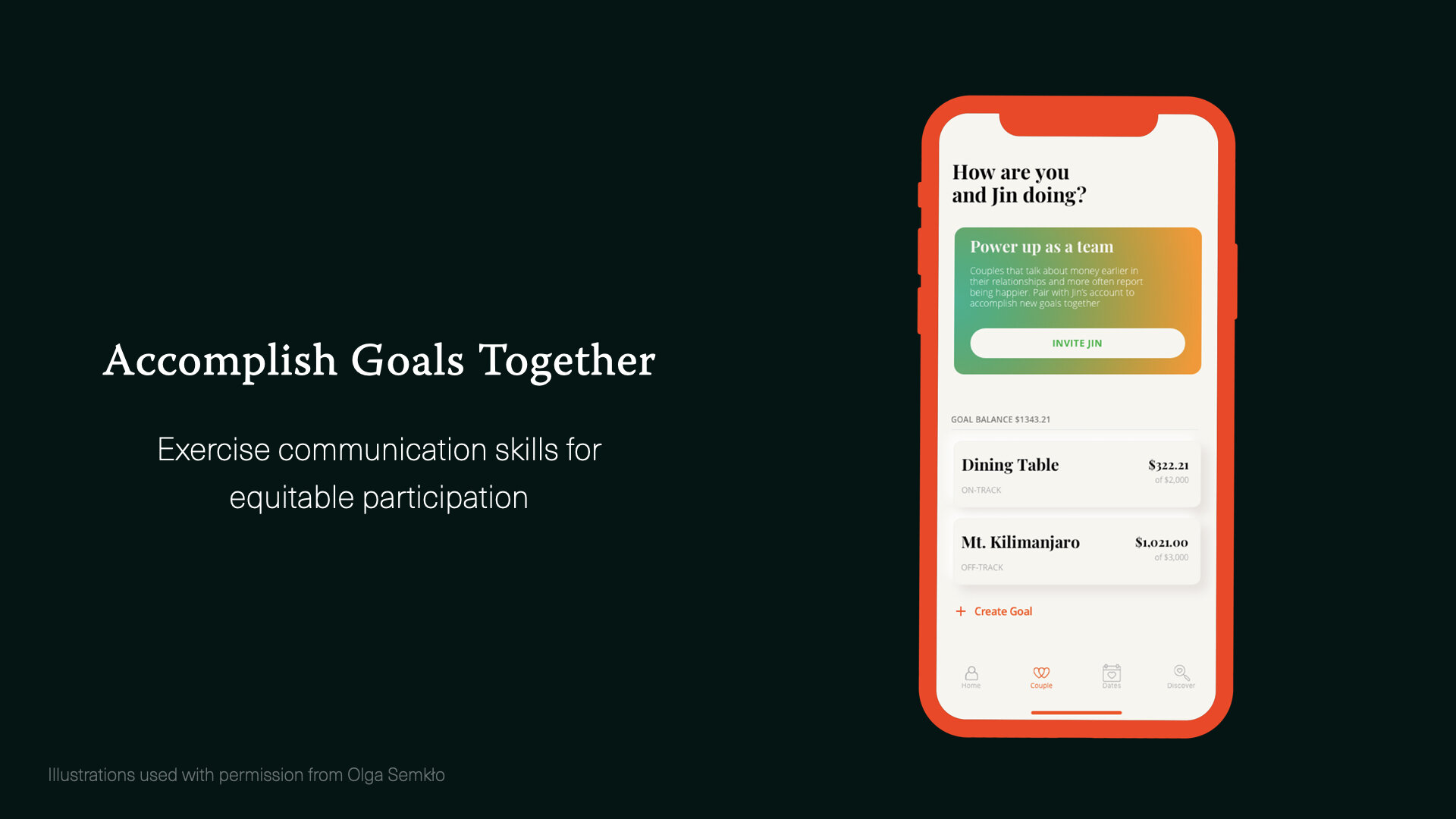

Talking about money earlier and more often is advantageous in relationships. Still, many available products are aimed toward couples that have already married or share their finances. However, Yuko notes that “many of the financial advisors I spoke to noted that these conversations need to happen before that point. It’s often too late by the time they are moving in or married.” To meet this need for a younger demographic, Power Couple introduces younger professional couples to healthier financial discussions and provides an introductory mechanism for collaborating on shared financial goals.

The Money Coven workshop participants expressed in their tarot card readings that conflicting values around finances create strain in relationships and families. The 1999 “Gender Socialization and Money” study by Michael D. Newcomb and Jerome Rabow also reveals that most parents tend to have very different practices and expectations for sons and daughters that influence their financial outcomes, so Yuko approached the household as a leverage point for enabling generational change.

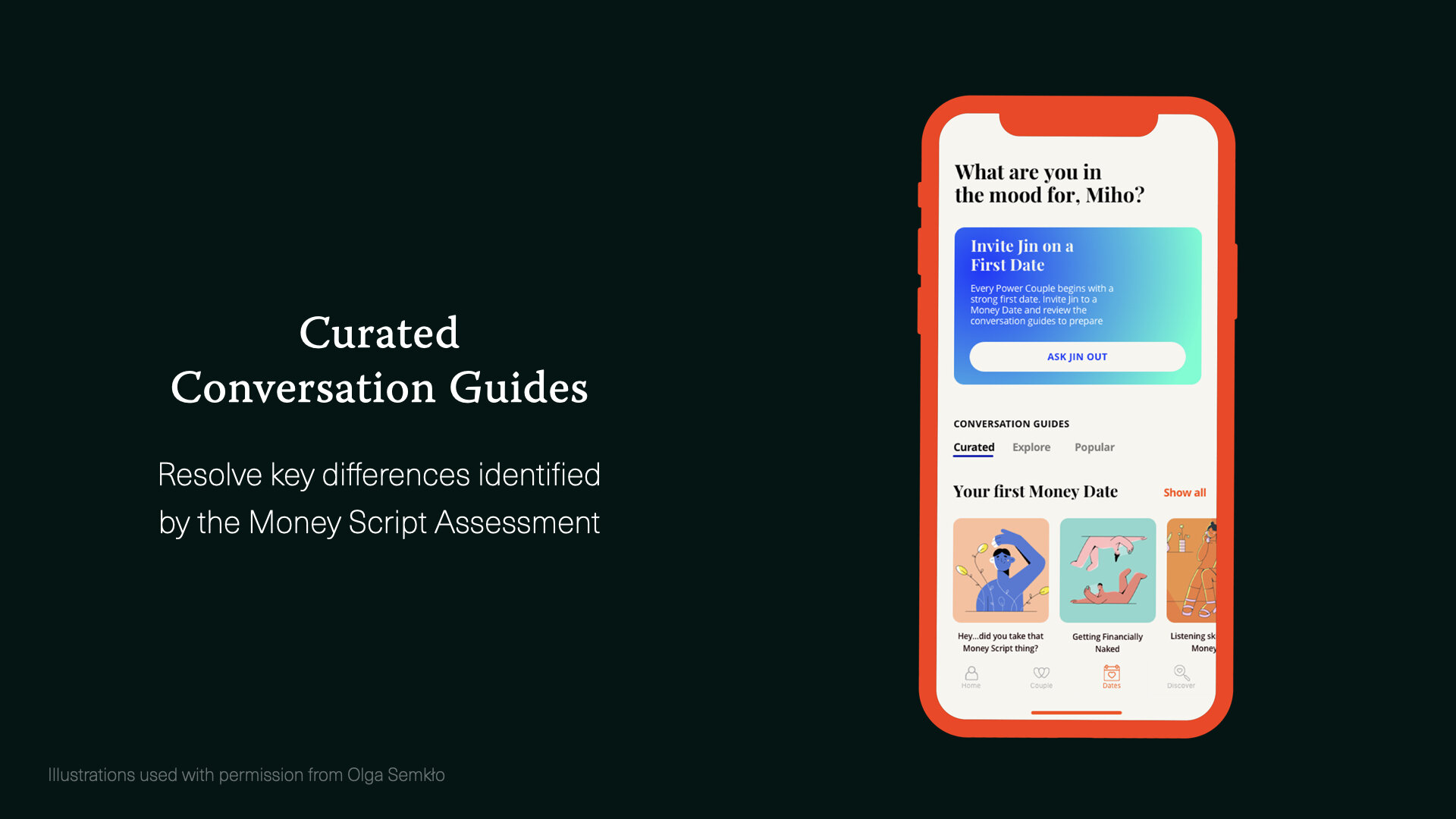

The three capabilities include the Money Script Assessment, curated conversation guides, and shared goal-setting. Through the Money Script Assessment, couples can uncover their differences and similarities in beliefs about money. The software reconciles the data and pinpoints the differences that can be resolved through conversation guides selected for the couple. As the couple develops their communication skills, they can work on accomplishing financial goals together and feel stronger in their relationship as a result.

Yuko Kanai is a strategic product designer based in NYC. Her preoccupation with finances stems from the belief that financial power is a feminist imperative. Through her thesis, she hopes to propose a new set of strategies that elevates femininity as a source of power and inform the way more inclusive financial products and services are designed. To learn more about Yuko’s work, take a look at her projects in more detail at www.yukokanai.com.